North Dakota oil boom

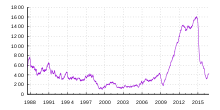

The North Dakota oil boom refers to the period of rapidly expanding oil extraction from the Bakken formation in the state of North Dakota that lasted from the discovery of Parshall Oil Field in 2006, and peaked in 2012,[1][2] but with substantially less growth noted since 2015 due to a global decline in oil prices.[3] Despite the Great Recession, the oil boom resulted in enough jobs to provide North Dakota with the lowest unemployment rate in the United States.[4][5] The boom has given the state of North Dakota, a state with a 2013 population of about 725,000, a billion-dollar budget surplus. North Dakota, which ranked 38th in per capita gross domestic product (GDP) in 2001, rose steadily with the Bakken boom, and now has per capita GDP 29% above the national average.[6]

There are three reasons for the oil boom, in North Dakota as well as elsewhere in America:

- the recent discoveries of shale gas reserves in the United States

- initiatives to seek independence from unstable energy sources, such as Venezuela and nations in the Middle East

- the successful use of horizontal drilling and hydraulic fracturing, which have made energy deposits recoverable[7]

The leases expire after their primary term, commonly three to five years, unless the lessee oil company drills and starts producing, in which case the leases continue as long as oil and gas are continually produced. Expiring leases result in a push to commence drilling and production on as many as possible before they expire.

Economic effects

By 2012, income from oil royalties was reportedly paying many local mineral owners $50,000 to $60,000 per month, and some more than $100,000 per month. Bruce Gjovig, head of the UND Center for Innovation Foundation in Grand Forks, estimated that the boom was creating 2,000 millionaires per year in North Dakota. The average income in Mountrail County has more than doubled since the boom started, to $52,027 in 2010, putting it into the top 100 richest counties in the United States.[8]

The oil boom reduced unemployment in North Dakota to 3.5 percent in December 2011, the lowest of any state in the US.[9][10]

The number of actively-drilling rigs in North Dakota peaked at 217 rigs in Spring 2012, with the rig count averaging 180-190 throughout 2013.[11] Each of the rigs is estimated to create roughly 125 new full-time jobs. This means a total growth of around 25,000 jobs, including an extra 10,000 jobs for workers who lay pipes to producing wells and produce processing plants.[10] Some estimates predict that North Dakota could have as many as 48,000 new wells, with drilling taking place over the next two to three decades.

The Bakken boom has propelled North Dakota into the top ranks of oil-producing states. As recently as 2007, North Dakota ranked 8th among the states in oil production. In 2008, the state overtook Wyoming and New Mexico; in 2009 it outproduced Louisiana and Oklahoma. North Dakota surpassed California in oil production in December 2011, then in March 2012 overtook Alaska, to become the number two oil-producing state in the country, exceeded only by Texas.[12]

Government revenue

The North Dakota state government receives through severance taxes 11.5 percent of the gross value of all oil produced.[13] The boom has given the state of North Dakota a billion-dollar budget surplus.[9][10]

In addition to severance taxes, the state of North Dakota owns extensive mineral rights, which are leased by competitive bidding. In fiscal year 2010, the State Land Department reported that mineral income on its land earned $265 million for the North Dakota school trust fund, and that the trust fund had grown to $1.3 billion.[14]

The federal government is also a major owner of mineral rights in the region, and leases the rights to companies in competitive bidding. In a January 2013 federal lease sale, the top bid was $19,500 per acre for a lease on one tract in North Dakota. Of the lease sale and royalties from the federal tracts, the federal government keeps 52 percent, and passes 48 percent on to the state of North Dakota.[15]

Social and infrastructure effects

The industrialization and population boom has put a strain on roads, water supplies, sewage systems, and government services in the area. Some counties have increased in population by almost double from 20,000 to 40,000.[9][10]

The boom has brought with it increases in crime and social problems.[16][17] The addition of thousands of oil workers has led to a housing shortage, requiring the construction of camps for housing them. Law enforcement agencies have reported sharp increases in offenses, particularly violent crime,[18] drug trafficking,[19] gun crimes,[20] and prostitution.[21][22][23] These problems are similar to those found in other regions in which energy industry workers have taken temporary jobs.[21] A 2012 report indicated that conditions were improving.[16] As of October 2013, the FBI's Project Safe Bakken had stationed additional full-time agents in the area.[22]

The boom has seen dramatic increases in the infrastructure of Western North Dakota. Examples of oil industry related infrastructure investments in Williston, North Dakota are the multi-acre branch campus of Baker Hughes, the Sand Creek Retail Center, Jim Bridger shops & offices.

The oil boom's effect on families is the subject of the Academy Award-nominated documentary short film, White Earth.[24]

See also

- Bakken formation

- Peak oil

- The Overnighters, a documentary film about workers in the North Dakota oil boom

- Marcellus natural gas trend

- Blood & Oil a fictional 2015 TV series that takes place in North Dakota

References

- ↑ Nicas, Jack (6 April 2012). "Oil Fuels Population Boom in North Dakota City". Wall Street Journal. Retrieved 17 April 2012.

- ↑ Oldham, Jennifer (25 January 2012). "North Dakota Oil Boom Brings Blight With Growth as Costs Soar". Bloomberg. Retrieved 17 April 2012.

- ↑ Reuters Energy Update: Helmerich & Payne may cut 2,000 jobs as it idles rigs. Published Thursday, January 29, 2015. http://www.reuters.com/article/2015/01/29/helmerichpayne-results-idUSL4N0V85NJ20150129

- ↑ Gebrekidan, Selam (8 March 2012). "Shale boom turns North Dakota into No. 2 oil producer". Reuters. Retrieved 17 April 2012.

- ↑ Ellis, Blake (20 October 2011). "Double your salary in the middle of nowhere, North Dakota". CNN. Retrieved 17 April 2012.

- ↑ US Energy Information Administration, North Dakota sees growth in real GDP, 12 July 2013.

- ↑ The facts about fracking. (2011, June 25). The Wall Street Journal.

- ↑ David Baily, North Dakota millionaires, Reuters, 3 Oct. 2012.

- 1 2 3 "New Boom Reshapes Oil World, Rocks North Dakota". NPR. 2011-09-25. Retrieved 2011-12-02.

- 1 2 3 4 "Oil Boom Puts Strain On North Dakota Towns". NPR. 2011-12-02. Retrieved 2011-12-02.

- ↑ https://www.dmr.nd.gov/oilgas/riglist.asp

- ↑ US EIA, Oil production, accessed 20 Sept. 2013.

- ↑ North Dakota, Oil and gas taxes, accessed 17 Sept. 2013.

- ↑ North Dakota, Fiscal year 2010 report, 2011

- ↑ US Bureau of Land management, BLM Montana Dakotas lease sale, January 2013.

- 1 2 Associated Press (2012-04-23). "Bakken oil booms _ and so does crime on the Plains". Fox News. Retrieved 2013-12-10.

- ↑ Associated Press (2013-10-11). "As Bakken oil patch booms, drug arrests rise". USA Today. Retrieved 2013-12-10.

- ↑ Brown, Matthew (2013-10-11). "Drug arrests spike as Bakken oil patch booms". Missoulian. Retrieved 2014-04-17.

- ↑ Kolpack, Dave (2013-07-18). "Drug czar visit highlights oil patch's drug issues". Missoulian. Retrieved 2014-04-17.

- ↑ Lutey, Tom (2013-07-20). "Feds say Mexican drug cartels operating in Bakken oil towns". Missoulian / Billings Gazette. Retrieved 2014-04-17.

- 1 2 Kidston, Martin (2014-04-17). "Sex trafficking easy to find in Montana, speakers at UM say". Missoulian. Retrieved 2014-04-17.

- 1 2 Kolpack, Dave (2013-10-27). "Top federal law enforcement agents tour Bakken oil field". Missoulian. Retrieved 2014-04-17.

- ↑ Lymn, Katherine (7 January 2015). "North Dakota men change with the oil boom". Bismarck: The Bismarck Tribune. Retrieved 7 January 2015.

- ↑ Skirble, Rosanne (19 February 2015). "Oscar-Nominee 'White Earth' Depicts N. Dakota Oil Boom Through Children's Eyes". Voice of America. Retrieved 24 February 2015.