Tax Reform Act of 1986

.svg.png) | |

| Long title | An Act to reform the internal revenue laws of the United States. |

|---|---|

| Acronyms (colloquial) | TRA |

| Nicknames | Tax Reform Act of 1985 |

| Enacted by | the 99th United States Congress |

| Effective | October 22, 1986 |

| Citations | |

| Public law | 99-514 |

| Statutes at Large | 100 Stat. 2085 |

| Codification | |

| Titles amended | 26 U.S.C.: Internal Revenue Code |

| U.S.C. sections amended | 26 U.S.C. § 1 et seq. |

| Legislative history | |

| |

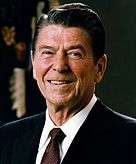

The U.S. Congress passed the Tax Reform Act of 1986 (TRA) (Pub.L. 99–514, 100 Stat. 2085, enacted October 22, 1986) to simplify the income tax code, broaden the tax base and eliminate many tax shelters. Referred to as the second of the two "Reagan tax cuts" (the Kemp-Roth Tax Cut of 1981 being the first), the bill was also officially sponsored by Democrats, Richard Gephardt of Missouri in the House of Representatives and Bill Bradley of New Jersey in the Senate.

The Tax Reform Act of 1986 was given impetus by a detailed tax-simplification proposal from President Reagan's Treasury Department, and was designed to be tax-revenue neutral because Reagan stated that he would veto any bill that was not. Revenue neutrality was targeted by decreasing individual income tax rates, eliminating $30 billion annually in loopholes, while increasing corporate taxes, capital gains taxes, and miscellaneous excises.[1] The act raised overall revenue by $54.9 billion in the first fiscal year after enactment [2] As of 2014, the Tax Reform Act of 1986 was the most recent major simplification of the tax code, drastically reducing the number of deductions and the number of tax brackets (for the individual income tax) to three.[3]

Income tax rates

The top tax rate for individuals was lowered from 50% to 28% while the bottom rate was raised from 11% to 15%.[4] Many lower level tax brackets were consolidated, and the upper income level of the bottom rate (married filing jointly) was increased from $5,720/year to $29,750/year. This package ultimately consolidated tax brackets from fifteen levels of income to four levels of income.[5] This would be the only time in the history of the U.S. income tax (which dates back to the passage of the Revenue Act of 1862) that the top rate was reduced and the bottom rate increased concomitantly. In addition, capital gains faced the same tax rate as ordinary income.

The rate structure also maintained a novel "bubble rate." The rates were not 15%/28%, as widely reported. Rather, the rates were 15%/28%/33%/28%. As a result, for taxpayers after a certain income level, TRA86 provided a flat tax of 28%. This was jettisoned in the Omnibus Budget Reconciliation Act of 1990, otherwise known as the "Bush tax increase", which violated his Taxpayer Protection Pledge.

Tax incentives

The Act also increased incentives favoring investment in owner-occupied housing relative to rental housing by increasing the Home Mortgage Interest Deduction. The imputed income an owner receives from an investment in owner-occupied housing has always escaped taxation, much like the imputed (estimated) income someone receives from doing his own cooking instead of hiring a chef, but the Act changed the treatment of imputed rent, local property taxes, and mortgage interest payments to favor homeownership, while phasing out many investment incentives for rental housing. To the extent that low-income people may be more likely to live in rental housing than in owner-occupied housing, this provision of the Act could have had the tendency to decrease the new supply of housing accessible to low-income people. The Low-Income Housing Tax Credit was added to the Act to provide some balance and encourage investment in multifamily housing for the poor.

Moreover, interest on consumer loans such as credit card debt was no longer deductible. An existing provision in the tax code, called Income Averaging, which reduced taxes for those only recently making a much higher salary than before, was eliminated (although later partially reinstated, for farmers in 1997 and for fishermen in 2004). The Act, however, increased the personal exemption and standard deduction.

The Individual Retirement Account (IRA) deduction was severely restricted. The IRA had been created as part of the Employee Retirement Income Security Act of 1974, where employees not covered by a pension plan could contribute the lesser of $1500 or 15% of earned income.[6] The Economic Recovery Tax Act of 1981 (ERTA) removed the pension plan clause and raised the contribution limit to the lesser of $2000 or 100% of earned income. The 1986 Tax Reform Act retained the $2000 contribution limit, but restricted the deductibility for households that have pension plan coverage and have moderate to high incomes. Non-deductible contributions were allowed.

Depreciation deductions were also curtailed. Prior to ERTA, depreciation was based on "useful life" calculations provided by the Treasury Department. ERTA set up the "accelerated cost recovery system," or ACRS. This set up a series of useful lives based on 3 years for technical equipment, 5 years for non-technical office equipment, 10 years for industrial equipment, and 15 years for real property. TRA86 lengthened these lives, and lengthened them further for taxpayers covered by the alternative minimum tax (AMT). These latter, longer lives approximate "economic depreciation," a concept economists have used to determine the actual life of an asset relative to its economic value.

Defined contribution (DC) pension contributions were curtailed. The law prior to TRA86 was that DC pension limits were the lesser of 25% of compensation or $30,000. This could be accomplished by any combination of elective deferrals and profit sharing contributions. TRA86 introduced an elective deferral limit of $7000, indexed to inflation. Since the profit sharing percentage must be uniform for all employees, this had the intended result of making more equitable contributions to 401(k)'s and other types of DC pension plans.

Fraudulent dependents

The act required people claiming children as dependents on their tax returns to obtain and list a Social Security number for every claimed child, to verify the child's existence. Before this act, parents claiming tax deductions were on the honor system not to lie about the number of children they supported. The requirement was phased in, and initially Social Security numbers were required only for children over the age of 5. During the first year, this anti-fraud change resulted in seven million fewer dependents being claimed, nearly all of which are believed to have involved either children that never existed, or tax deductions improperly claimed by non-custodial parents.[7]

Changes to the AMT

The original Alternative Minimum Tax targeted tax shelters used by a few wealthy households. However, the Tax Reform Act of 1986 greatly expanded the AMT to aim at a different set of deductions that most Americans receive. Things like the personal exemption, state and local taxes, the standard deduction, private activity bond interest, certain expenses like union dues and even some medical costs for the seriously ill could now trigger the AMT. In 2007, the New York Times reported, "A law for untaxed rich investors was refocused on families who own their homes in high tax states."[8]

Passive losses and tax shelters

By enacting 26 U.S.C. § 469 (relating to limitations on deductions for passive activity losses and limitations on passive activity credits) to remove many tax shelters, especially for real estate investments, the Act significantly decreased the value of many such investments which had been held more for their tax-advantaged status than for their inherent profitability. This may have contributed to the end of the real estate boom of the early-to-mid 1980s as well as to the savings and loan crisis.

Prior to 1986, much real estate investment was done by passive investors. It was common for syndicates of investors to pool their resources in order to invest in property, commercial or residential. They would then hire management companies to run the operation. TRA 86 reduced the value of these investments by limiting the extent to which losses associated with them could be deducted from the investor's gross income. This, in turn, encouraged the holders of loss-generating properties to try and unload them, which contributed further to the problem of sinking real estate values.

Mortgages and similar real property loans constituted a significant portion of S&Ls' asset portfolios. Significant declines in the market value of real properties resulted in the erosion of the value of these institutions' major assets.

Some economists consider the net long-term effect of eliminating tax shelters and other distortions to be positive for the economy, by redirecting money to productive investments.

To help less-affluent landlords, TRA86 gave a $25,000 net rental loss deduction provided that the home was not personally used for the greater of 14 days or 10% of rental days, and AGI is less than $100,000 (pro-rated phase-out through $150,000).

Tax treatment of technical service firms employing certain professionals

The Internal Revenue Code does not contain any definition or rules dealing with the issue of when a worker should be characterized for tax purposes as an employee, rather than as an independent contractor. The tax treatment depends on the application of (20) factors provided by common law, which varies by state.

Introduced by Senator Daniel Patrick Moynihan, Section 1706 added a subsection (d) to Section 530 of the Revenue Act of 1978, which removed "safe harbor" exception for independent contractor classification (which at the time avoided payroll taxes) for workers such as engineers, designers, drafters, computer professionals, and "similarly skilled" workers.

If the IRS determines that a third-party intermediary firm's worker previously treated as self-employed should have been classified as an employee, the IRS assesses substantial back taxes, penalties and interest on that third-party intermediary company, though not directly against the worker or the end client.[9] It does not apply to individuals directly contracted to clients.[10]

The change in the tax code was expected to offset tax revenue losses of other legislation Moynihan proposed that changed the law on foreign taxes of Americans working abroad.[11] At least one firm simply adapted its business model to the new regulations.[12] A 1991 Treasury Department study found that tax compliance for technology professionals was among the highest of all self-employed workers and that Section 1706 would raise no additional tax revenue and could possibly result in losses as self-employed workers did not receive as many tax-free benefits as employees.[13]

In one report in 2010, Moynihan's initiative was labeled "a favor to IBM."[14] A suicide note by software professional Joseph Stack, who flew his airplane into a building housing IRS offices in February 2010, blamed his problems on many factors, including the Section 1706 change in the tax law while even mentioning Senator Moynihan by name, though no intermediary firm is mentioned, and failure to file a return was admitted.[15]

Name of the Internal Revenue Code

Section 2(a) of the Act also officially changed the name of the Internal Revenue Code from the Internal Revenue Code of 1954 to the Internal Revenue Code of 1986. Although the Act made numerous amendments to the 1954 Code, it was not a re-enactment or a substantial re-codification or reorganization of the overall structure of the 1954 Code. Thus, the tax laws since 1954 (including those after 1986) have taken the form of amendments to the 1954 Code, although it is now called the 1986 Code.

See also

References

- ↑ Bradley, Bill (2009-08-29). "Tax Reform's Lesson for Health Care Reform". New York Times. Retrieved 2012-01-28.

- ↑ Tax Policy Center. "Historical Federal Receipt and Outlay Summary". taxpolicycenter.org. Retrieved 2014-06-13.

- ↑ "Tax Reform Might Start With a Look Back to '86". The New York Times. November 22, 2012. Retrieved 2014-01-19.

- ↑ "10 Reasons Reagan Could Cut The Top Tax Rate To 28%, But Romney Can't". Forbes.com. Retrieved 2014-01-19.

- ↑ "Federal Individual Income Tax Rates History" (PDF). TaxFoundation.org. 1913–2009. Retrieved 2009-03-06.

- ↑ Graney, Paul J. (2004). Retirement Savings Plans. Nova Publishers. p. 45. ISBN 159033907X.

- ↑ Jeffrey B. Liebman (December 2000). "Who Are the Ineligible EITC Recipients?". National Tax Journal. 53: 1165–1186.

- ↑ Hulse, Carl; Lee, Suevon (2007). "Alternative Minimum Tax". New York Times. Retrieved 2008-05-16.

- ↑ "Internal Revenue Manual - 4.23.5 Technical Guidelines for Employment Tax Issues". irs.gov. Retrieved 2014-06-13.

- ↑ "IRS Rev. Rul. 87-41". web.archive.org. Retrieved 2014-06-13.

- ↑ "New Tax Law threatens high-tech consultants" by Karla Jennings, The New York Times, February 22, 1987. Retrieved 2010-06-17.

- ↑ Andrew Davis, Synergistech Communications. Laws affecting Brokered Independent Contractors' tax status. 2007-03. URL:http://www.synergistech.com/ic-taxlaw.shtml. 2010-08-22. (Archived by WebCite at http://www.webcitation.org/5sBKtV48u)

- ↑ "Taxation of technical services personnel : section 1706 of the Tax Reform Act of 1986 : a report to the Congress". archive.org. Retrieved 2014-06-13.

- ↑ "Tax Law Was Cited in Software Engineer’s Suicide Note" by David Kay Johnston, The New York Times, February 18, 2010. Retrieved 2010-06-17.

- ↑ "WebCite query result". webcitation.org. Archived from the original on February 18, 2010. Retrieved 2014-06-13.

External links

- Campaign 2000 Information Page, Citizens for Tax Justice "scorecard."

- Showdown at Gucci Gulch: Lawmakers, Lobbyists and the Unlikely Triumph of Tax Reform (1987), by Jeffrey Birnbaum and Alan Murray, is a book about the bill's passage.

- Full text of the Act

- Apps, P. F. (2010, June). Why the Henry Review Fails on Family Tax Reform. In Australia’s Future Tax System: A Post-Henry Review'Conference, Sydney.