Nikkei 225

The Nikkei 225 (日経平均株価 Nikkei heikin kabuka, 日経225), more commonly called the Nikkei, the Nikkei index, or the Nikkei Stock Average[1][2] (/ˈnɪkeɪ/, /ˈniːkeɪ/, or /nɪˈkeɪ/), is a stock market index for the Tokyo Stock Exchange (TSE). It has been calculated daily by the Nihon Keizai Shimbun (Nikkei) newspaper since 1950. It is a price-weighted index (the unit is yen), and the components are reviewed once a year. Currently, the Nikkei is the most widely quoted average of Japanese equities, similar to the Dow Jones Industrial Average. In fact, it was known as the "Nikkei Dow Jones Stock Average" from 1975 to 1985.[3]

The Nikkei 225 began to be calculated on September 7, 1950, retroactively calculated back to May 16, 1949. Since January 2010 the index is updated every 15 seconds during trading sessions.

The Nikkei 225 Futures, introduced at Singapore Exchange (SGX) in 1986, the Osaka Securities Exchange (OSE) in 1988, Chicago Mercantile Exchange (CME) in 1990, is now an internationally recognized futures index.[4]

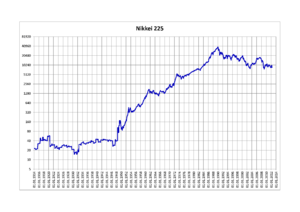

The Nikkei average has deviated sharply from the textbook model of stock averages which grow at a steady exponential rate. The average hit its all-time high on December 29, 1989, during the peak of the Japanese asset price bubble, when it reached an intra-day high of 38,957.44 before closing at 38,915.87, having grown sixfold during the decade. Subsequently, it lost nearly all these gains, closing at 7,054.98 on March 10, 2009—81.9% below its peak twenty years earlier.

Another major index for the Tokyo Stock Exchange is the Topix.

On March 15, 2011, the second working day after the massive earthquake in the northeast part of Japan, the index dropped over 10% to finish at 8605.15, a loss of 1,015 points. The index continued to drop throughout 2011, eventually bottoming out at 8160.01 on November 25, putting it at its lowest close since March 10, 2009. The Nikkei fell over 17% in 2011, finishing the year at 8455.35, its lowest year-end closing value in nearly thirty years, when the index finished at 8016.70 in 1982.[5]

The Nikkei started 2013 near 10,600, hitting a peak of 15,942 in May. However, shortly afterward, it plunged by almost 10% before rebounding, making it the most volatile stock market index among the developed markets. By 2015, it has reached over 20,000 mark; marking a gain of over 10,000 in 2 years making it one of the fastest growing stock market indexes in the world.

Weighting

The index is a price-weighted index. As of late 2014, the company with the largest influence on the index is Fast Retailing.

Annual returns

| Year | Returns |

|---|---|

| 1997 | -21.19% |

| 1998 | -9.29% |

| 1999 | +36.79% |

| 2000 | -27.19% |

| 2001 | -23.52% |

| 2002 | -18.63% |

| 2003 | +24.45% |

| 2004 | +7.61% |

| 2005 | +40.24% |

| 2006 | +6.92% |

| 2007 | -11.13% |

| 2008 | -42.12% |

| 2009 | +19.04% |

| 2010 | -3.01% |

| 2011 | -17.34% |

| 2012 | +22.94% |

| 2013 | +56.72% |

| 2014 | +7.12%[6] |

| 2015 | +9.07% |

Components

As of December 2015, the Nikkei 225 consists of the following companies: (Japanese securities identification code in parentheses)

Foods

- Ajinomoto Co., Inc. (TYO: 2802)

- Asahi Breweries, Ltd. (TYO: 2502)

- Japan Tobacco Inc. (TYO: 2914)

- Kikkoman Corp. (TYO: 2801)

- Kirin Brewery Co., Ltd. (TYO: 2503)

- Meiji Holdings Company, Limited (TYO: 2269)

- Nichirei Corp. (TYO: 2871)

- Nippon Meat Packers, Inc. (TYO: 2282)

- Nisshin Seifun Group Inc. (TYO: 2002)

- Sapporo Holdings Ltd. (TYO: 2501)

- Takara Holdings Inc. (TYO: 2531)

Textiles & apparel

- Nisshinbo Industries, Inc. (TYO: 3105)

- Teijin Ltd. (TYO: 3401)

- Toray Industries, Inc. (TYO: 3402)

- Toyobo Co., Ltd. (TYO: 3101)

- Unitika, Ltd. (TYO: 3103)

Pulp & paper

- Hokuetsu Paper Mills, Ltd. (TYO: 3865)

- Nippon Paper Group, Inc. (TYO: 3863)

- Oji Paper Co., Ltd. (TYO: 3861)

Chemicals

- Asahi Kasei Corp. (TYO: 3407)

- Denki Kagaku Kogyo K.K. (TYO: 4061)

- Fujifilm Holdings Corp. (TYO: 4901)

- Kao Corp. (TYO: 4452)

- Kuraray Co., Ltd. (TYO: 3405)

- Mitsubishi Chemical Holdings Corp. (TYO: 4188)

- Mitsui Chemicals, Inc. (TYO: 4183)

- Nippon Kayaku Co., Ltd. (TYO: 4272)

- Nippon Soda Co., Ltd. (TYO: 4041)

- Nissan Chemical Industries, Ltd. (TYO: 4021)

- Nitto Denko (TYO: 6988)

- Shin-Etsu Chemical Co., Ltd. (TYO: 4063)

- Shiseido Co., Ltd. (TYO: 4911)

- Showa Denko K.K. (TYO: 4004)

- Sumitomo Chemical Co., Ltd. (TYO: 4005)

- Tokuyama Corporation (TYO: 4043)

- Tosoh Corp. (TYO: 4042)

- Ube Industries, Ltd. (TYO: 4208)

Pharmaceuticals

- Astellas Pharma Inc. (TYO: 4503)

- Chugai Pharmaceutical Co., Ltd. (TYO: 4519)

- Daiichi Sankyo Co., Ltd. (TYO: 4568)

- Dainippon Sumitomo Pharma Co., Ltd. (TYO: 4506)

- Eisai Co., Ltd. (TYO: 4523)

- Kyowa Hakko Kirin Co., Ltd. (TYO: 4151)

- Shionogi & Co., Ltd. (TYO: 4507)

- Takeda Pharmaceutical Company, Ltd. (TYO: 4502)

Oil & coal products

- JX Holdings (TYO: 5020)

- Showa Shell Sekiyu K.K. (TYO: 5002)

Rubber products

- Bridgestone Corp. (TYO: 5108)

- The Yokohama Rubber Co., Ltd. (TYO: 5101)

Glass & ceramics

- Asahi Glass Co., Ltd. (TYO: 5201)

- NGK Insulators, Ltd. (TYO: 5333)

- Nippon Electric Glass Co., Ltd. (TYO: 5214)

- Nippon Sheet Glass Co., Ltd. (TYO: 5202)

- Sumitomo Osaka Cement Co., Ltd. (TYO: 5232)

- Taiheiyo Cement Corp. (TYO: 5233)

- Tokai Carbon Co., Ltd. (TYO: 5301)

- Toto Ltd. (TYO: 5332)

Steel products

- JFE Holdings, Inc. (TYO: 5411)

- Kobe Steel, Ltd. (TYO: 5406)

- Nippon Steel Corp. (TYO: 5401)

- Nisshin Steel Co., Ltd. (TYO: 5413)

- Pacific Metals Co., Ltd. (TYO: 5541)

- Sumitomo Metal Industries, Ltd. (TYO: 5405)

Nonferrous metals

- Dowa Holdings Co., Ltd. (TYO: 5714)

- Fujikura Ltd. (TYO: 5803)

- Furukawa Co., Ltd. (TYO: 5715)

- The Furukawa Electric Co., Ltd. (TYO: 5801)

- Mitsubishi Materials Corp. (TYO: 5711)

- Mitsui Mining & Smelting Co., Ltd. (TYO: 5706)

- Nippon Light Metal Co., Ltd (TYO: 5703)

- SUMCO Corp. (TYO: 3436)

- Sumitomo Electric Industries, Ltd. (TYO: 5802)

- Sumitomo Metal Mining Co., Ltd. (TYO: 5713)

- Toho Zinc Co., Ltd. (TYO: 5707)

- Toyo Seikan Kaisha, Ltd. (TYO: 5901)

Machinery

- Amada Co. Ltd. (TYO: 6113)

- Chiyoda Corp. (TYO: 6366)

- Daikin Industries, Ltd. (TYO: 6367)

- Ebara Corp. (TYO: 6361)

- Hitachi Construction Machinery Co., Ltd. (TYO: 6305)

- Hitachi Zōsen Corporation (TYO: 7004)

- IHI Corp. (TYO: 7013)

- The Japan Steel Works, Ltd. (TYO: 5631)

- JTEKT Corp. (TYO: 6473)

- Komatsu Ltd. (TYO: 6301)

- Kubota Corp. (TYO: 6326)

- Mitsubishi Heavy Industries, Ltd. (TYO: 7011)

- NSK Ltd. (TYO: 6471)

- NTN Corp. (TYO: 6472)

- Okuma Holdings, Inc. (TYO: 6103)

- Sumitomo Heavy Industries, Ltd. (TYO: 6302)

Electric machinery

- Advantest Corp. (TYO: 6857)

- Alps Electric Co., Ltd. (TYO: 6770)

- Canon Inc. (TYO: 7751)

- Casio Computer Co., Ltd. (TYO: 6952)

- Dainippon Screen Mfg. Co., Ltd. (TYO: 7735)

- Denso Corp. (TYO: 6902)

- FANUC Corp. (TYO: 6954)

- Fuji Electric Holdings Co., Ltd. (TYO: 6504)

- Fujitsu Ltd. (TYO: 6702)

- GS Yuasa Corp. (TYO: 6674)

- Hitachi, Ltd. (TYO: 6501)

- Kyocera Corp. (TYO: 6971)

- Panasonic Corp. (TYO: 6752)

- Meidensha Corp. (TYO: 6508)

- Minebea Co., Ltd. (TYO: 6479)

- Mitsubishi Electric Corp. (TYO: 6503)

- Mitsumi Electric Co., Ltd. (TYO: 6767)

- NEC Corp. (TYO: 6701)

- Oki Electric Industry Co., Ltd. (TYO: 6703)

- Pioneer Corporation (TYO: 6773)

- Ricoh (TYO: 7752)

- Sharp Corp. (TYO: 6753)

- Sony Corp. (TYO: 6758)

- Taiyo Yuden Co., Ltd. (TYO: 6976)

- TDK Corp. (TYO: 6762)

- Tokyo Electron Ltd. (TYO: 8035)

- Toshiba Corp. (TYO: 6502)

- Yaskawa Electric Corporation, Limited (TYO: 6506)

- Yokogawa Electric Corp. (TYO: 6841)

Shipbuilding

- Kawasaki Heavy Industries, Ltd. (TYO: 7012)

- Mitsui Engineering & Shipbuilding Co., Ltd. (TYO: 7003)

Automotive

- Fuji Heavy Industries Ltd. (TYO: 7270)

- Hino Motors, Ltd. (TYO: 7205)

- Honda Motor Co., Ltd. (TYO: 7267)

- Isuzu Motors Ltd. (TYO: 7202)

- Mazda Motor Corp. (TYO: 7261)

- Mitsubishi Motors Corp. (TYO: 7211)

- Nissan Motor Co., Ltd. (TYO: 7201)

- Suzuki Motor Corp. (TYO: 7269)

- Toyota Motor Corp. (TYO: 7203)

Precision instruments

- Citizen Holdings Co., Ltd. (TYO: 7762)

- Konica Minolta Holdings, Inc. (TYO: 4902)

- Nikon Corp. (TYO: 7731)

- Olympus Corp. (TYO: 7733)

- Terumo Corp. (TYO: 4543)

Other manufacturing

- Dai Nippon Printing Co., Ltd. (TYO: 7912)

- Toppan Printing Co., Ltd. (TYO: 7911)

- Yamaha Corp. (TYO: 7951)

Fishery

- Nippon Suisan Kaisha, Ltd. (TYO: 1332)

- Maruha Nichiro Holdings, Inc. (TYO: 1333)

Mining

Construction

- Comsys Holdings Corp. (TYO: 1721)

- Daiwa House Industry Co., Ltd. (TYO: 1925)

- JGC Corporation (TYO: 1963)

- Kajima Corp. (TYO: 1812)

- Obayashi Corp. (TYO: 1802)

- Sekisui House, Ltd. (TYO: 1928)

- Shimizu Corp. (TYO: 1803)

- Taisei Corp. (TYO: 1801)

- Haseko Corp. (TYO: 1808)

Trading companies

- Itochu Corp. (TYO: 8001)

- Marubeni Corp. (TYO: 8002)

- Mitsubishi Corp. (TYO: 8058)

- Mitsui & Co., Ltd. (TYO: 8031)

- Sojitz Corp. (TYO: 2768)

- Sumitomo Corp. (TYO: 8053)

- Toyota Tsusho Corp. (TYO: 8015)

Retail

- Aeon Co., Ltd. (TYO: 8267)

- Fast Retailing Co., Ltd. (TYO: 9983)

- Isetan Mitsukoshi Holdings Ltd. (TYO: 3099)

- J. Front Retailing Co., Ltd. (TYO: 3086)

- Marui Group Co., Ltd. (TYO: 8252)

- Seven & I Holdings Co., Ltd. (TYO: 3382)

- Takashimaya Co., Ltd. (TYO: 8233)

- Uny Co., Ltd. (TYO: 8270)

Banking

- Aozora Bank, Ltd. (TYO: 8304)

- The Bank of Yokohama, Ltd. (TYO: 8332)

- The Chiba Bank, Ltd. (TYO: 8331)

- Sumitomo Mitsui Trust Holdings, Inc. (TYO: 8309)

- Fukuoka Financial Group, Inc. (TYO: 8354)

- Mitsubishi UFJ Financial Group, Inc. (TYO: 8306)

- Mizuho Financial Group, Inc. (TYO: 8411)

- Resona Holdings, Inc. (TYO: 8308)

- Shinsei Bank, Ltd. (TYO: 8303)

- The Shizuoka Bank, Ltd. (TYO: 8355)

- Sumitomo Mitsui Financial Group, Inc. (TYO: 8316)

Securities

- Daiwa Securities Group Inc. (TYO: 8601)

- Matsui Securities Co., Ltd. (TYO: 8628)

- Nomura Holdings, Inc. (TYO: 8604)

Insurance

- Dai-ichi Life Insurance Company, Limited (TYO: 8750)

- MS&AD Insurance Group, Inc. (TYO: 8725)

- NKSJ Holdings, Inc. (TYO: 8830)

- Sony Financial Holdings Inc. (TYO: 8729)

- T&D Holdings, Inc. (TYO: 8795)

- Tokio Marine Holdings, Inc. (TYO: 8766)

Other financial services

- Credit Saison Co., Ltd. (TYO: 8253)

Real estate

- Mitsubishi Estate Co., Ltd. (TYO: 8802)

- Mitsui Fudosan Co.,Ltd (TYO: 8801)

- Sumitomo Realty & Development Co., Ltd. (TYO: 8830)

- Tokyo Tatemono Co., Ltd. (TYO: 8804)

- Tokyu Land Corp. (TYO: 3289)

Railway/bus

- Central Japan Railway Company (TYO: 9022)

- East Japan Railway Company (TYO: 9020)

- Keio Corp. (TYO: 9008)

- Keisei Electric Railway Co., Ltd. (TYO: 9009)

- Odakyu Electric Railway Co., Ltd. (TYO: 9007)

- Tobu Railway Co., Ltd. (TYO: 9001)

- Tokyu Corp. (TYO: 9005)

- West Japan Railway Company (TYO: 9021)

Other land transport

- Nippon Express Co., Ltd. (TYO: 9062)

- Yamato Holdings Co., Ltd. (TYO: 9064)

Marine transport

- Kawasaki Kisen Kaisha, Ltd. (TYO: 9107)

- Mitsui O.S.K. Lines, Ltd. (TYO: 9104)

- Nippon Yusen K.K. (TYO: 9101)

Air transport

- All Nippon Airways Co., Ltd. (TYO: 9202)

Warehousing

- Mitsubishi Logistics Corp. (TYO: 9301)

Communications

- KDDI Corp. (TYO: 9433)

- Nippon Telegraph and Telephone Corp. (TYO: 9432)

- NTT Data Corp. (TYO: 9613)

- NTT DoCoMo, Inc. (TYO: 9437)

- SKY Perfect JSAT Holdings Inc. (TYO: 9412)

- Softbank Corp. (TYO: 9984)

Electric power

- Chubu Electric Power Co., Inc. (TYO: 9502)

- The Kansai Electric Power Co., Inc. (TYO: 9503)

- The Tokyo Electric Power Co., Inc. (TYO: 9501)

Gas

Services

See also

References

- ↑ "the Nikkei (index) definition, meaning - what is the Nikkei (index) in the British English Dictionary & Thesaurus - Cambridge Dictionaries Online". cambridge.org.

- ↑ "Yahoo". Yahoo.

- ↑ Nikkei Definition via Wikinvest

- ↑ Nikkei Net Interactive

- ↑ "Finfacts: Irish business, finance news on economics". finfacts.com.

- ↑ http://indexes.nikkei.co.jp/en/nkave/archives/data

External links

- Nikkei 225 Components (Official webpage)

- Bloomberg page for NKY:IND

- Nikkei 225 index on Yahoo! Finance

- Nikkei 225 index on Google Finance

- Nikkei 225 profile at Wikinvest

- Reuters page for .N225