Indian Chartered Accountancy Course

In India Chartered Accountancy course is provided by The Institute of Chartered Accountants of India. It is one of the biggest accounting bodies in the world in terms of members.

| Accounting |

|---|

|

|

Major types |

|

Selected accounts |

|

People and organizations

|

|

Development |

|

|

Qualification

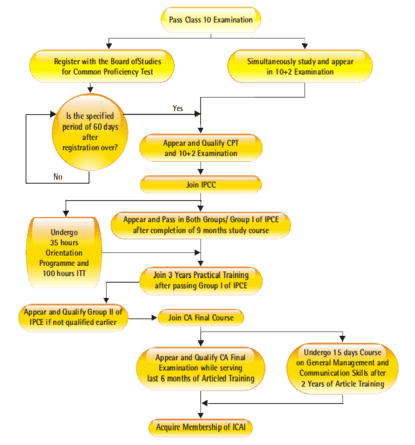

A person can apply for membership either by passing all three levels of examinations prescribed by Institute of Chartered Accountants of India and completing three years of practical training or by availing themselves of exemptions under mutual recognition agreements (MRAs).[1]

Examination

The CA course[2] is designed to combine theoretical study with practical training. The Chartered Accountancy course is considered to be one of the most toughest, rigorous professional courses both in India and Worldwide with only 3-8 % of the students passing [3] in every attempt in Inter and Final Level. At Present, pass rate in Foundation is Approx 15%, Inter 4-8 %, Final 3-7 %, that means students who take admission in CA Course, only 0.0225% to 0.096% actually pass CA. For instance,in the November 2013 CA Final exam, the pass percentage was merely 3.11% (Both Groups) As of April 2010, The prestigious institute has 874,694 students, studying various levels of the Chartered Accountancy Course.[4] The Chartered Accountancy examinations are divided into three levels. They are

- Common Proficiency Test (CPT)

- Integrated Professional Competence Course (IPCC)

- Final Examination [5]

[6] CPT covers four basic subjects viz. Fundamentals of Accounting, Mercantile Laws, Economics and Quantitative Aptitude. Fundamentals of Accounting carries 60 marks, Mercantile Laws carries 40 marks and Economics & Quantitative Aptitude carries 50 marks each. A person can register for CPT after completing Grade 10 and take the exam after completing High School (Grade 12). Every incorrect answer on the CPT exam carries a 0.25 negative mark. A candidate is considered to have cleared CPT if he/she obtains in a sitting 30% in each of the 4 sections and a 50.00% aggregate in the entire examination.[7] This amendment was enforced by ICAI on 16 August 2012.The amendment was made public vide ICAI's website notification. CPT exams are held in June and December in paper pencil mode. Mock test/Model test papers are available on the institute website.

[8] CPT Subjects According To New Syllabus 2016 Form 2016 new syllabus cpt course will be called as Foundation course.[9] It will have six subjects i.e. two subjects are added to previous course. The two new subjects are Business communication and General English. Six subjects of foundation course.

- Paper 1 : Fundamentals OF Accounting

- Paper 2 : Quantitative aptitude

- Paper 3 A: Mercantile Law

- Paper 3 B: General Economics

- Paper 4 : General English

- Paper 4 B: Business Communication

[10] IPCC or Integrated Professional Competence Course is the second level of Chartered Accountancy examinations. A person can take the IPCC Examination after passing CPT and nine months of study. IPCC has two groups of seven subjects. Group – I consists of four subjects and Group – II of three subjects.

Group I:

- Paper 1 : Accounting

- Paper 2 : Business Laws, Ethics and Communication

- Paper 3 : Cost Accounting and Financial Management

- Paper 4 : Taxation

Group II:

- Paper 5 : Advanced Accounting

- Paper 6 : Auditing and Assurance

- Paper 7 : Information Technology and Strategic Management

A passing grade in IPCC is awarded if the candidate obtains 40% marks in each subject (a subject is attributed 100 marks) and an aggregate of 50% in the aggregate in each group. Benefit of set-off is also available if the candidate appears for both groups together and obtains 50% collectively in both groups, even if he fails to obtain an individual aggregate of 50% in the each group independently.

CA Final Examination is the last and final level of Chartered Accountancy Examinations. It is considered as one of the toughest exam in the world.[11] Any person who has passed both the groups of IPCC, during the last six months of articleship can take the Final Examination. This exam consists of two groups of four subjects[12] each.

Group I:

- Paper 1 : Financial Reporting,

- Paper 2 : Strategic Financial Management,

- Paper 3 : Advanced Auditing and Professional Ethics,

- Paper 4 : Corporate and Allied Laws,

Group II:

- Paper 5 : Advanced Management Accounting,

- Paper 6 : Information Systems Control and Audit,

- Paper 7 : Direct Tax Laws

- Paper 8 : Indirect Tax Laws.

ICAI conducts CPT exams in June and December, IPCC and Final examinations in May and November each year. Examinations are conducted in major cities in India and other countries such as Abu Dhabi (U.A.E.), Dubai (U.A.E.) and Kathmandu (Nepal). ICAI updates the content and format of examinations periodically keeping in view the technical progress and changes in practice of the profession. The ICAI last revised its training course for membership in 2008.[13]

Articled and industrial training

After passing Group – I of IPCC, a candidate must undergo a rigorous 3-year training as article or audit assistant, article ship. Only members in practice are entitled to engage such assistants. The Institute strictly governs through Regulations,[1] the stipends, working hours and working conditions of such assistants. Articles provide CA firms a steady supply of motivated assistants while providing the students with invaluable training. Audits are normally conducted by partnering senior and junior assistants with a supervising partner of the firm. This provides steady increase in the depth and variety of experience to the Articled Assistants. During the last year of article ship, a student may opt for industrial training instead. Industrial training can be for a period of 9 to 12 months and has to be completed under the supervision of an existing CA member employee of a financial, commercial or industrial organization. Over the years several cases of abuse of the system such as articles being made to work long hours, work without pay/delayed payments, or being made to perform personal tasks for their Principals, some faking their training (also called dummy articles, i.e. not going to the office but spending time studying at home or in coaching classes) led the institute to start enforcement of rules and regulations in the interest of the profession.[14] Chartered Accountants may not provide coaching classes during working hours, as students are expected to apply themselves wholly to practical training in that time.[15] An article may complain to the Disciplinary Committee against a member or firm for non-compliance with regulations.

GMCS

General Management and Communication Skills Course or GMCS is a 15-day mandatory course and was introduced in 2002 to improve business communication, presentation and interpersonal skills of Chartered Accountants. Completion of the course is a pre-requisite for obtaining membership and can be taken during the last 12 months of Articleship,[16] after completing the IPCC examinations.

Earlier a student was required to complete only one 15 Day GMCS Session to be eligible to apply for membership of ICAI but, after April 2012, 2 GMCS courses of 15 days each have been made mandatory.[17] The 1st 15-day GMCS Course is required to be completed in the 1st year of articleship and the 2nd 15-day GMCS Course is required to be completed after completion of 18 months of articleship but before the completion of Articleship Training.

For the students who have joined the articleship training on or after 1 May 2012 have to be successfully complete GMCS I within the first year of the training. They will be eligible for GMCS II from the completion of one and half-year of training period but before completion of the 3 years training period......

Advanced ITT

Advanced Information Technology Training should be done during third year of articleship but before appearing in Final Examination. Applicable for students registered on or after February 1, 2013 (initially August 1, 2012 but postponed).[18] Hence students who commenced their articleship on or after February 1, 2013 and are eligible to appear in November, 2015 Examination have to undergo this training. Students who have already taken orientation programme (op) and joined article from 2014 will not be needed to take gmcs 1.

CPT Exemption for Graduates

With effect from 1 August 2012 onward, CPT is exempted for the following class of Individuals[19]

- Commerce Graduates with more than 55% marks from a recognised university

- Non-Commerce Graduates with more than 60% Marks and who has passed the Intermediate Exam conducted by the Institute of Cost Accountants of India or by the Institute of Company Secretaries of India

Those Candidates who are exempted from clearing CPT Exam[20] can also directly register for articleship without clearing IPCC Group 1 as is the case with those candidates who have registered for the CA Course through the CPT Route.

Other qualifications and certifications

With the introduction of IPCC scheme of exams, ICAI also introduced the accounting technician course.[13] Any person who passes Group-I of IPCC and completes one year of practical training under a member can apply for an Accounting Technician Certification. After obtaining the certificate the person can designate himself as an Accounting Technician. This Certification was introduced to help a large number of students who were unable to complete the CA Final Examinations and obtain membership.

ICAI has entered into agreements with various universities such as the Indira Gandhi National Open University, Bharathiar University and Netaji Subhas Open University to help CA students acquire a Bachelor of Commerce (B.Com) degree, writing a few papers to supplement the IPCC.

Mutual recognition agreements[21]

The second method of obtaining membership is through mutual recognition agreements or MRAs. ICAI has entered into MRAs with several institutes globally, of equivalent standing, to enable members of those institutes to acquire membership of ICAI and to enable the members of ICAI to gain membership of its counterpart in other country.This is done by granting some exemptions in the regular scheme of examination and training.

ICAI currently has MRAs with following professional accounting bodies:

- Institute of Chartered Accountants in England and Wales (since 20 November 2008)[22]

- Institute of Chartered Accountants in Australia (since 2009)

- The New Zealand Institute of Chartered Accountants[23]

- CPA Australia(originally signed in February 2009 and re-signed in September 2014)[24][25]

- Institute of Chartered Accountants of Nepal[26]

- Institute of Certified Public Accountants in Ireland (since October 2010)[27][28]

- Canadian Institute of Chartered Accountants (since 2011)[29]

ICAI is also in process of negotiating MRAs with Hong Kong Institute of Certified Public Accountants and Certified General Accountants Association of Canada.

Memorandum of Understanding[21]

The Institute of Chartered Accountants of India (ICAI) has signed Memorandum of Understanding (MOU) with professional accounting bodies of various countries. These MOUs aim at establishing mutual co-operation between the two institutions for the advancement of accounting knowledge, professional and intellectual development, advancing the interests of their respective members and positively contributing to the development of the accounting profession.

Currently ICAI has MOUs with following professional accounting bodies:

- Accounting and Auditing Standards Board of Bhutan, Bhutan (signed on 22 November 2013)[30]

- The Vietnam Association of Certified Public Accountants, Vietnam[31]

- Saudi Organization for Certified Public Accountants (SOCPA), Saudi Arabia (since 2014 for a period of 3 years)[32]

- Higher Colleges of Technology, UAE (signed on 4 January 2011)[33]

- College of Banking and Financial Studies, Oman[34]

Courses for members

ICAI provides various professional certifications for its members. Some of them are as follows:

Certificate Courses on Enterprise risk management, Corporate governance, International taxation, Forensic accounting & Fraud detection using IT [35] & CAATs, International Financial Reporting Standards, Forex and Treasury Management, Derivatives, Valuation and Arbitration.

Post Qualification Courses such as Diploma Information Systems Audit (ISA), CPE Course on Computer Accounting and Auditing Techniques (CAAT), Trade Laws & World Trade Organisation (ITL & WTO), ERP Courses on SAP FA & MA Module, Microsoft Dynamics NAV.

Placement

The Institute maintains a placement portal on its web site for qualified members and partially qualified students. This is supplemented with campus placement events and advertising through its professional journals and website.

See also

- Education in India

- Institute_of_Chartered_Accountants_of_India

- Chartered_accountant

- Logic School of Management

References

- 1 2 The Chartered Accountants Regulations, 1988

- ↑ "CA Course Details (Updated)".

- ↑ Prasad, Suresh. "Analysis of 12 Years CA Final Pass Percentage 2003-2014". AUBSP. Retrieved 21 January 2015.

- ↑ "ICAI Annual Report 2009-2010 Pg:113" (PDF). ICAI. Retrieved 5 March 2011.

- ↑ "Levels of CA examination in India". Institute of Chartered Accountants of India. Retrieved 23 August 2015.

- ↑ "CA Exam".

- ↑ http://www.cacracker.com/ca-cpt-passing-marks-rule-applicability-30-for-each-section/

- ↑ "ca course details". www.aiming.in. aiming.in. Retrieved 6 October 2015.

- ↑ "CA Foundation Course".

- ↑ http://cacharya.com/about-ipcc

- ↑ http://us.talentlens.com/quality-of-hire/worlds-toughest-tests-and-final-exams

- ↑ "ca final subjects".

- 1 2 ICAI Board of Studies Announcement of the new scheme

- ↑ Working Hours for Article Assistants

- ↑ ICAI notification against coaching classes during office hours, 28 January 2010

- ↑ "articleship status".

- ↑ 2 GMCS Course have been made mandatory

- ↑ http://www.icai.org/new_post.html?post_id=10957

- ↑ CPT is exempt for the following class of Individuals

- ↑ CPT Exam

- 1 2 "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-23.

- ↑ ICAI Signed MoU with ICAEW, ICAI website

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-23.

- ↑ "Institute of Chartered Accountants India". www.cpaaustralia.com.au. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICA India". www.cpaireland.ie. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-23.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "ICAI - The Institute of Chartered Accountants of India". ICAI. Retrieved 2016-07-24.

- ↑ "Students' Handbook on Forensic Accounting". fraudexpress. Retrieved 2014-05-18.