Buy term and invest the difference

Buy term and investing the difference is a concept involving term life insurance and investment strategies that allows individuals to eventually "self Insure" and provides an alternative to permanent life insurance. Generally speaking term insurance premiums are considerably less expensive in the short term than permanent life insurance for an individual for the same benefit amount. Permanent programs are more expensive because they force the policy owner to "Self Insure" by combining some form of cash accumulation with the insurance program as a single package. The same cash accumulation, or cash value, will pay for the increasing cost of insurance as the insured ages. The insured losses the cash value upon death, since "Guaranteed Death Benefits" means only the death benefits will be given to the beneficiary(ies) upon death claim while the insurance company keeps the cash value. Consumers making use of the "buy term and invest the difference" concept separate their investments from their insurance by setting aside money every month equal to the premium that a permanent plan would require, then use a portion of this money for the term premium and place the rest in a tax-deferred investment vehicle.

Cases for and against implementing the strategy

The advantages of this strategy, if implemented correctly by the Theory of Decreasing Responsibility, are the ability to Self insure and get rid of the need for insurance, immediate accumulation of investment moneys, more investment options that may allow for similar tax advantages, and return of cash accumulation. Other advantages include elimination of loans and stability in the death benefit. In some cases, there are no investment options with similar tax advantages to permanent life insurance, such as when an investor in the United States makes too much income to qualify for a Roth IRA. Or a person's need to save annually in a tax deferred account exceeds the yearly contribution limits.

Self insuring

This strategy assumes consumers will self insure on their own and will eventually be able to eliminate the need for permanent insurance which forces them to self insure. Most responsibilities for which life insurance is purchased are temporary in nature (paying off mortgage and/or debts, provide education for dependents and create cash reserves to replace the income of the breadwinner). In the event of the insured's death, many or all of these responsibilities can be resolved using the proceeds from the policy or policies. When the consumer has cash reserves large enough, they consider themselves to be "self insured". Insurance terms may be a number of years in length (1, 5, 10, 20, 25, 30, 35 years or more) which, in theory, should provide enough time for the insured to invest and eliminate these responsibilities. In the event these responsibilities are not eliminated at the end of the term, many insurers will allow the insured to renew their current policy (guaranteed renewal) or purchase a new policy (conversion) without being subject to the same medical and financial qualifications as a new applicant. The premium rates for policies renewed or converted are not guaranteed however, and may be many times higher than the original premiums. The higher rates could be unaffordable or unreasonable. The difference invested in high yield registered segregated funds (Registered Retirement Savings Plan and Tax-Free Savings account) will have grown big enough to eliminate the need for insurance. The Rule of 72 explains how compounding works. Investments made directly through fund managers and not the banks (middlemen) are effective ways of avoiding bank charges and low interest rates from Guaranteed Income Certificates (GIC's) that are not inflation-proof.

Those who believe in buying term insurance and investing the difference in premium between a term and permanent policy must intend to self insure (invest the difference), since the term policy will eventually expire or become too expensive. If they are not disciplined enough to invest, pay off their debts, or assist their dependants in becoming independent, they still have a need for insurance. However, the discipline is in the form of investing in registered segregated funds which are guaranteed upon death or maturity. Registration offers tax advantage in the form of Registered Retirement Savings Plan which are tax deductible or Tax Free Savings Account which grow at high interest tax-free.

Accumulation of investment money

With the concept of buying term instead of permanent insurance, more investment vehicles are available, all of which are independent of the insurance program and remain in control by the insured if the insurance portion is cancelled. All cash accumulated is available based on the investment vehicle selected by the investor not the insurance company (granted the investment vehicle could be a sock drawer in which the cash is readily accessible but not growing). However, if the investments are made in high yield segregated funds, the investments will grow safely. Segregated funds have two guarantees, i.e. death and maturity. Unlike bank deposits where the guaranty is limited to a maximum of $100,000 by CDIC, segregated funds protected by Assuris has at least 85% guaranty if the investment is higher than $80,000.

Permanent or whole life insurance (life insurance that typically provides a death benefit for the lifetime of an insured person up to age 100) policies usually direct a portion of the premium payment to a sub-account within the policy, called cash value and the other portion to insurance which is in the form of yearly renewable term insurance. There are many different permanent life insurance products available with a range of options involving the cash value of the policy, including the ability to withdraw the cash value, borrow against it, and to allow it to be drawn on to pay the insurance portion without additional premium payments. Ultimately, all permanent life insurance policies are combination of yearly renewable term insurance with a savings vehicle. Insurers may break down a policy into 2 components, the yearly renewable term insurance portion (the net amount at risk) and the cash value (the guaranteed amount). However, the Caveat Emptor is "Guaranteed Death Benefits", where the beneficiary(ies) will receive only the death benefits upon death claim, while the insurance company keeps the cash value. Buy term and invest the difference is the only solution against this cash value scam.

The cash value in the sub-account can accumulate over the life of the policy depending on the policy, however it is not always available for the first several years of the program because the agent's commission has to be paid first. Universal and Variable or Variable Universal policies typically have immediate accumulation in the sub-account, but these funds may not available for loans and are typically subject to a surrender charges for the first several years of the program. In the case of plans paying a premium close to the minimum, the surrender charge is frequently in excess of the accumulation. Simply put "Initially, there are no surrender charges, since the cash value is zero in the first five years." The tax free portion of the available loan is equal to the Adjusted Cost Basis (Total Premiums less Net Cost of Pure Insurance). When the Adjusted Cost Basis gets depleted, the policy fails MTAR test by CRA.

Again, this approach requires discipline. As with budgeting, many consumers who reduce expenditures fail to invest the money saved, and simply allow it to be reabsorbed to become part of their monthly spending. An example is someone who quits smoking thinking of all the money they'll save. Looking at things a few years later, it is a rare occurrence for anyone to actually have a large amount of money in their special "non-smoking" investment account. But if money is invested in high yield segregated funds, the investment grows with two guarantees, i.e., death or maturity. The Rule of 72 provide how compounding interest works.

Just because one does not have the discipline to invest, it does not mean one can be scammed by permanent insurance's cash value under the guise of "Guaranteed Death Benefits".

Investment options

Buying term and investing the difference leaves the insured open to utilize whatever investment options they see fit. Permanent programs require the policy holder to use only the investment options available through the policy. Neither Term nor Permanent life insurance death benefits are generally subject to Federal income tax if the premiums are paid with after tax money. Death benefits are, however, potentially subject to Estate (Death) taxation, depending on how the ownership of the policy is structured and the size of the estate. Given current estate tax law, very few estates are large enough to cause estate tax to be due. Cash value growth in permanent plans is tax-deferred as long as the policy is in force. If the policy is canceled (because the need for insurance is eliminated) any accumulation in excess of the adjusted cost base (ACB) will be taxable. Permanent insurance policies typically allow access to the accumulated cash value through loans. If the policy is structured to reduce the death benefit as much as possible as the cash value is loaned out, the cost of insurance can be kept to a minimum while still qualifying an insurance policy under tax law. In this way, the proceeds from the investment inside of the permanent insurance policy can potentially be withdrawn tax free, provided the policy pass the tax-exempt test. Premiums for insurance policies are most often paid with after tax money, though there are exceptions where the policy holder can use pretax money (as a business obligation in a corporation for example). Variable plans provide the insured the opportunity to choose the investments, though the investment vehicle is still within the life insurance plan. The policy is still subject to MTAR test (Maximum Tax Actuarial Reserve). If it fails, it turns into a taxable modified endowment contract.

To attain similar tax advantages, the insured may make investments through a tax deferred vehicle, such as an annuity, variable annuity, IRA, Roth IRA or even 529. Monies applied to a traditional IRA is pretax money while that applied to a Roth IRA are after tax. Both investment vehicles grow tax-deferred, similar to cash accumulation; however money withdrawn from a Roth are not taxed. 529s are educational accounts, and annuities are another form of life insurance account. (see http://www.irs.gov/pub/irs-pdf/p590.pdf https://web.archive.org/web/20060427093611/http://www.irs.gov:80/retirement/article/0,,id=136868,00.html). However, tax advantage of the cash value is limited only the (ACB) Adjusted Cost Basis of the policy. As the insured ages, the cost of insurance increases, resulting in the depletion of the ACB. ACB is the tax-portion of the cash value which is equal to the premiums paid less net cost of insurance.

Each program has provisions for accessing monies invested early as does permanent insurance; however as a separate investment the term insurance death benefit is not impacted by accessing it. Accessing monies from permanent insurance is done by policy loan or by cancellation. The former incurs interest upon payment of the loan while the latter incurs cash surrender charges.

Again this requires the implementer to research investments and how to best take advantage of them. The caveat emptor of permanent insurance is "Guaranteed Death Benefits", i.e. upon death claim, the beneficiary receives only the Death Benefits while the insurance company keeps the cash value, i.e., cash value is a scam.

Other

Because of the increased premium at attained (then current) age, additional consideration should be given renewal or conversion of term insurance at the end of the original term. (In plain English review the renewal options to confirm renewal if required is not cost prohibitive). Also, purchasing annual renewable term insurance can add complexity to long-term investment strategies because premiums increase as the insured ages (so don't do this). To correctly implement this strategy term insurance with a Level premium should be used over an annual renewable source (ART, annual renewable term).

Annual renewable term (ART) insurance which is built-in permanent insurance(whole life and universal life) will eventually eat up the cash value when the premium is no longer enough to pay for the increasing cost of insurance of the ART. In permanent insurance (whole life or universal life) only death benefit is guaranteed, cash value is kept by the insurance company, i.e., cash value is a scam.

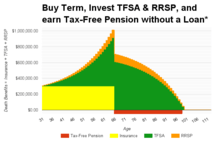

Here's an example of a year old who purchased a $300,000 term insurance for 35 years that typically costs between $40 to $50 per month. The difference is invested by maxing out the Tax Free Savings account at $458.33 per month while RRSP contribution is $75 per month until age 65. Assuming a 6% investment performance of the segregated funds, a maximum of $3.981 monthly tax free income from age 66 to 100 is possible. After 65 (retirement age), RRSP continues to max out TFSA contribution at $5500/year.

However, if this were a permanent insurance (whole life or universal life), this 30 year old will settle for a measly cash value loan in his or her retirement years. This loan reduces both the death benefits and the ACB (tax-free portion of the cash value). When the ACB gets depleted, the insurance loses its tax advantage. i.e., the insurance policy becomes a taxable endowment. This also happens when the policy fails the annual MTAR test by CRA. Borrowing from one's own money with interest is simply stupid specially during the retirement years.

In most Insured Retirement Plans, cash value loan is collateralised through a third party lender and annuitised as a tax-free retirement income. Technically the loan becomes a tax fraud waiting to be discovered, since there is no intention or means to pay the loan during the retirement years. If the 3rd party lender and the insurance company have the same owner, then there is conflict of interest in this plan.

Comparison

In a hypothetical scenario with maximum premiums a permanent life insurance policy that allows loans to draw out the maximum cash value as the death benefit decreases, the internal rate of return for the premiums compared to total withdrawals can be higher than buying term and investing the difference in anything but a Roth IRA. However, funding a permanent insurance policy at the maximum level (MTAR - Maximum Tax Actuarial Reserve) to avoid it turning into a modified endowment contract is rare. If the policy fails MTAR test, it loses its tax-exempt advantage. Because of this, insurance companies resort to transferring a portion of the cash value to a shuttle account which is another form of tax avoidance. Other companies who provide Insured Retirement Plans give bonuses to the policy holders to maintain the policy's MTAR level. Funding the policy at less than the MTAR, maximum rate, causes the costs of insurance and fees to be at higher percentage of the premiums and results in the cash value accumulating to a lower total, lowering the internal rate of return. Simply put "The cash value gets depleted in paying for the increasing cost of insurance as the insured ages when premium payment is no longer enough to keep the policy enforced". This is common in universal life policies with built-in Yearly Renewable Term Insurance. Using the buy term and invest the difference strategy where the entire investment is contributed to a Roth IRA, the internal rate of return is higher than any available permanent life insurance policy. The best investment option would be government registered investment programs that offer tax advantages, namely Registered Retirement Savings Plan and Tax-free Savings Account.

If the investor is unable or not disciplined enough to invest the difference, renewing will cost more after term insurance expires. Permanent insurance may be a better option because it has built-in cash value that will supplement the premium payments to keep up with the increasing cost of insurance from the yearly renewable term built within the policy. This explains why permanent life insurance policies contain the phrase "Guaranteed Death Benefits", i.e., upon death, the beneficiary(ies) will receive only the death benefits, while the insurance company keeps the cash value. This explains the cash value scam of permanent insurance.

If the insured dies too soon, Term Insurance provides the protection. otherwise, if the insured lives too long, segregated funds will have grown big enough to replace the expired term insurance. This a simple implementation of the Theory of Decreasing Responsibility.

If the insured has an emergency that requires funds, instead of policy loan the insured can access from the segregated funds. Withdrawal from segregated funds can be tax free if it is registered as tax free savings account.

If not maxed out, deposits to segregated funds registered as RRSP (Registered Retirement Savings Plan) are tax deductible. RRSP's and spousal RRSP's are ideal for those who like tax refunds.